Monitoring and managing short-term rental compliance, and their required transient room taxes, can be a daunting challenge in the Commonwealth.

Thursday afternoon, the Cadiz-Trigg County Tourist Commission took steps to make this a little easier, when board members unanimously approved a contract with iWorQ — a web-based management software for local government agencies to streamline solutions for tasks like permitting and code enforcement.

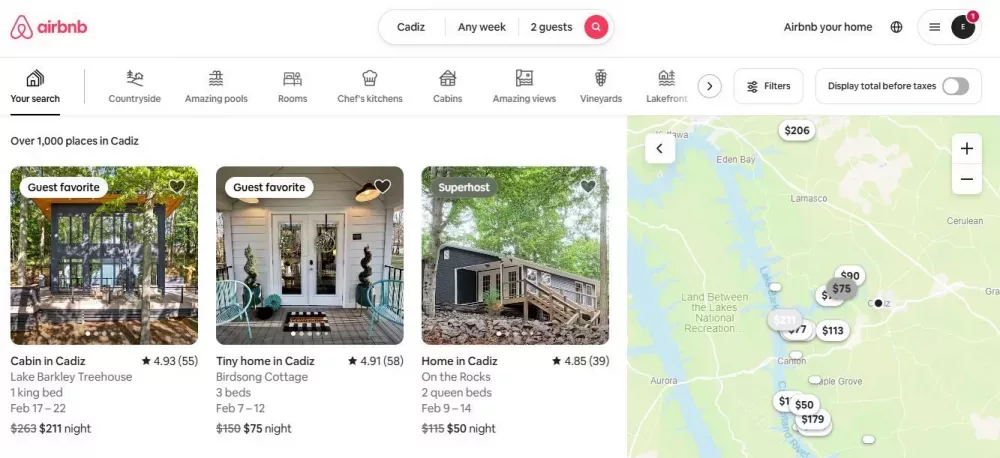

Valued at $5,000 in the first year, and $3,500 annually thereafter, Executive Director Beth Sumner said she and Guest Services Director Jamie Lewis recently went through a webinar with the company — one capable of pulling property information from giants like Airbnb and Vrbo, and comparing it with a PVA’s public data system.

Sumner and Lewis said this kind of cross-referencing task in house could prove “tedious and challenging,” and cited a need for outsourcing.

Furthermore, Sumner said that a preliminary report from iWorQ identified 40 locations that are already paying transient tax in Trigg County — including several hotels and Lake Barkley State Resort Park — but early estimates show at least 140 other properties in Trigg County are non-compliant, intentionally and/or unintentionally, in what could be close to $100,000 annually in missing tax revenue.

For comparison, Trigg County’s tourism budget in 2024-25 is roughly $750,000, and Sumner reminded the board that a big loss is coming this fall.

Sumner said a company like iWorQ possesses an easy-access database and a built-in communication system, where the Cadiz-Trigg County Tourism Commission could inform lodging guests of events, specials and other unique opportunities. It also can send out communique to the larger management companies, reminding officials to pay their transient taxes through an online portal — a service not yet available in the community.

Board member Matt Ladd asked what kind of penalties currently exist for non-compliance.

The answer, Sumner said, is not many.

And this stemmed conversation between board member Susan Bryant, Lewis and others.

In 2023, officials from the Kentucky League of Cities and the Kentucky Travel Industry Association filed a complaint — seeking declarations of judgement to enforce transient room tax legislation that has already been passed by the Kentucky General Assembly.

A suit was initiated in Franklin Circuit Court, one that asks Airbnb to comply with House Bill 8 from the 2022 legislative session, in order to collect and remit said tax, and pay cities the back taxes for those properties.

As of Thursday, this litigation remained unresolved, and attorneys for Airbnb are still seeking dismissal of the suit.

In other tourism news:

— Seeking guidance from her board, Sumner asked for the group to consider what level of sponsorships needed to be brought to a vote for the rest of this fiscal year, and what level could be administered at her discretion. Requests, she said, come in a rapid pace.

The board unanimously agreed for any requests totaling $3,000 or more need to have majority approval. Anything less can be Sumner’s decision.

Board member Nelson Green also offered clarity on Sumner’s concerns.

Simply put, Sumner said the time is nigh for an appropriate application process, because sponsorships should bring transient and restaurant tax to the community.

— Board members did approve a pair of renewal sponsorships: one for collegiate bass fisherman Jordan Hampton, one for the Trigg County Schools Athletic Program. Hampton will receive $7,500 over the next 18 months in exchange for a GoCadiz.com wrap on his boat, as well as multiple other requirements to be met on social media. Meanwhile, the Wildcats are upgrading their Turf Tank field sprayer at a cost of $3,000, and in exchange will continue to paint “GoCadiz” on Perdue Field.